Do You Have To Take Distributions From An Inherited Roth Ira . Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web unlike a traditional ira, a roth ira doesn't have a provision for required minimum distributions (rmds) at age 73. Web prior to the passage of the secure act in 2019, inherited roth ira beneficiaries could use the stretch ira. Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Web distributions from an inherited ira may be required. Keep in mind, though, that any voluntary or required minimum.

from twocents.lifehacker.com

Web prior to the passage of the secure act in 2019, inherited roth ira beneficiaries could use the stretch ira. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web unlike a traditional ira, a roth ira doesn't have a provision for required minimum distributions (rmds) at age 73. Keep in mind, though, that any voluntary or required minimum. Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web distributions from an inherited ira may be required.

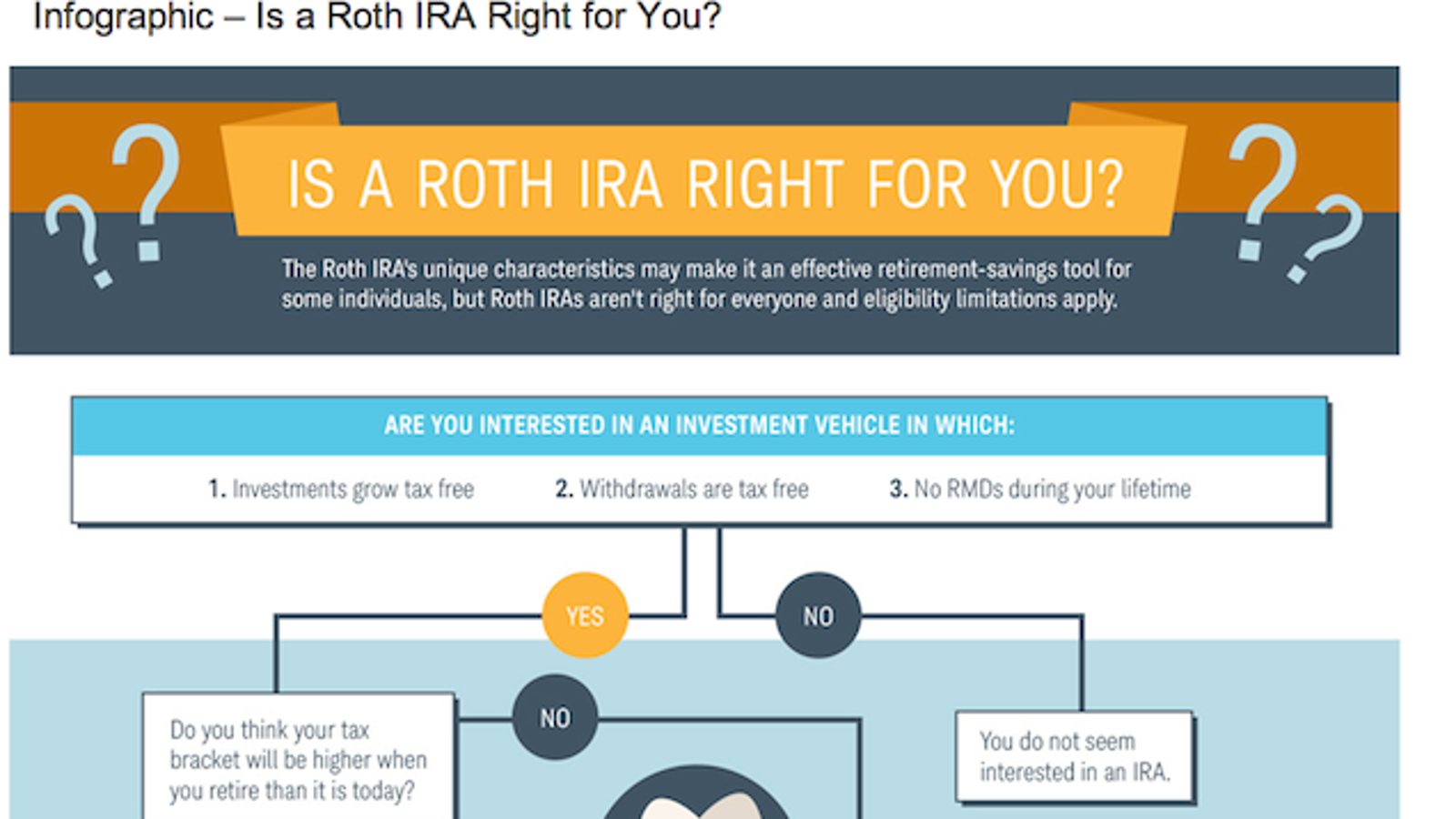

This Infographic Will Help You Decide Between a Roth or Traditional IRA

Do You Have To Take Distributions From An Inherited Roth Ira Web prior to the passage of the secure act in 2019, inherited roth ira beneficiaries could use the stretch ira. Keep in mind, though, that any voluntary or required minimum. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web unlike a traditional ira, a roth ira doesn't have a provision for required minimum distributions (rmds) at age 73. Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web distributions from an inherited ira may be required. Web prior to the passage of the secure act in 2019, inherited roth ira beneficiaries could use the stretch ira. Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions.

From www.m1finance.com

Early Distribution From An IRA Roth IRA Early Withdrawal Do You Have To Take Distributions From An Inherited Roth Ira Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Keep in mind, though, that any voluntary or required minimum. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web unlike a traditional ira,. Do You Have To Take Distributions From An Inherited Roth Ira.

From carolapandora.pages.dev

Inherited Roth Ira Rules 2024 Conny Tabbatha Do You Have To Take Distributions From An Inherited Roth Ira Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Keep. Do You Have To Take Distributions From An Inherited Roth Ira.

From corporatefinanceinstitute.com

Roth IRA Overview, How It Works, Advantages, and Disadvantages Do You Have To Take Distributions From An Inherited Roth Ira Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Web prior to the passage of the secure act in 2019, inherited roth ira beneficiaries could use the stretch ira. Web if your loved one died in 2020 or later, then you don't have to take required minimum. Do You Have To Take Distributions From An Inherited Roth Ira.

From www.pinterest.com

Do Roth IRAs Have RMDs (Required Minimum Distributions)? The Motley Do You Have To Take Distributions From An Inherited Roth Ira Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Keep in mind, though, that any voluntary or required minimum. Web unlike a traditional ira, a roth ira doesn't have a provision for. Do You Have To Take Distributions From An Inherited Roth Ira.

From penobscotfa.com

Roth Conversion Pros, Cons, and ‘Gotchas’ Penobscot Financial Advisors Do You Have To Take Distributions From An Inherited Roth Ira Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web unlike a traditional ira, a roth ira doesn't have a provision for required minimum. Do You Have To Take Distributions From An Inherited Roth Ira.

From www.nj.com

I have an inherited IRA. How soon do I have to take distributions? Do You Have To Take Distributions From An Inherited Roth Ira Web distributions from an inherited ira may be required. Web unlike a traditional ira, a roth ira doesn't have a provision for required minimum distributions (rmds) at age 73. Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web while you never have to withdraw money from your own roth ira, an inherited roth ira. Do You Have To Take Distributions From An Inherited Roth Ira.

From www.pinterest.com

Roth IRA Rules What You Need to Know in 2019 Roth ira rules, Roth Do You Have To Take Distributions From An Inherited Roth Ira Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web unlike a traditional ira, a roth ira doesn't have a provision for required minimum distributions (rmds) at age 73. Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web distributions from. Do You Have To Take Distributions From An Inherited Roth Ira.

From ira.gold

How Do I Report an Inherited Roth IRA Distribution? Gold IRA Do You Have To Take Distributions From An Inherited Roth Ira Web prior to the passage of the secure act in 2019, inherited roth ira beneficiaries could use the stretch ira. Web distributions from an inherited ira may be required. Keep in mind, though, that any voluntary or required minimum. Web unlike a traditional ira, a roth ira doesn't have a provision for required minimum distributions (rmds) at age 73. Web. Do You Have To Take Distributions From An Inherited Roth Ira.

From reviewhomedecor.co

Ira Rmd Table 2018 Review Home Decor Do You Have To Take Distributions From An Inherited Roth Ira Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web distributions from an inherited ira may be required. Keep in mind, though, that any voluntary or required minimum. Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web while you never. Do You Have To Take Distributions From An Inherited Roth Ira.

From enrichest.com

Understanding Roth IRA Qualified Distributions What You Need to Know Do You Have To Take Distributions From An Inherited Roth Ira Web prior to the passage of the secure act in 2019, inherited roth ira beneficiaries could use the stretch ira. Keep in mind, though, that any voluntary or required minimum. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web roth individual retirement accounts don’t have. Do You Have To Take Distributions From An Inherited Roth Ira.

From twocents.lifehacker.com

This Infographic Will Help You Decide Between a Roth or Traditional IRA Do You Have To Take Distributions From An Inherited Roth Ira Keep in mind, though, that any voluntary or required minimum. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web distributions from an inherited ira may be required. Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires. Do You Have To Take Distributions From An Inherited Roth Ira.

From blog.turbotax.intuit.com

Roth IRA Withdrawal Rules & Penalties Intuit TurboTax Blog Do You Have To Take Distributions From An Inherited Roth Ira Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web distributions from an inherited ira may be required. Web prior to the passage of. Do You Have To Take Distributions From An Inherited Roth Ira.

From carmichael-hill.com

Converting an IRA to a Roth IRA after age 60 Carmichael Hill Do You Have To Take Distributions From An Inherited Roth Ira Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Keep in mind, though, that any voluntary or required minimum. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web while you never have to withdraw money from your own roth ira,. Do You Have To Take Distributions From An Inherited Roth Ira.

From www.forbes.com

11Step Guide To IRA Distributions Do You Have To Take Distributions From An Inherited Roth Ira Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web. Do You Have To Take Distributions From An Inherited Roth Ira.

From endeavorwa.com

How Should I Take Distributions from My Inherited IRA? Endeavor Wealth Do You Have To Take Distributions From An Inherited Roth Ira Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web distributions from an inherited ira may be required. Keep in mind, though, that any voluntary or required minimum. Web while you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. Web unlike a traditional ira,. Do You Have To Take Distributions From An Inherited Roth Ira.

From www.carboncollective.co

Qualified vs NonQualified Roth IRA Distributions Do You Have To Take Distributions From An Inherited Roth Ira Web if your loved one died in 2020 or later, then you don't have to take required minimum distributions, or rmds, but you. Web distributions from an inherited ira may be required. Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web while you never have to withdraw money from your own roth ira, an. Do You Have To Take Distributions From An Inherited Roth Ira.

From www.pinterest.com

Why Consider a Roth IRA Conversion and How to Do It Roth ira, Roth Do You Have To Take Distributions From An Inherited Roth Ira Web distributions from an inherited ira may be required. Web prior to the passage of the secure act in 2019, inherited roth ira beneficiaries could use the stretch ira. Web unlike a traditional ira, a roth ira doesn't have a provision for required minimum distributions (rmds) at age 73. Web roth individual retirement accounts don’t have required minimum distributions during. Do You Have To Take Distributions From An Inherited Roth Ira.

From www.bankrate.com

Roth IRA Distribution Rules Possible Changes To Come Do You Have To Take Distributions From An Inherited Roth Ira Web unlike a traditional ira, a roth ira doesn't have a provision for required minimum distributions (rmds) at age 73. Web roth individual retirement accounts don’t have required minimum distributions during the original owner’s. Web distributions from an inherited ira may be required. Web while you never have to withdraw money from your own roth ira, an inherited roth ira. Do You Have To Take Distributions From An Inherited Roth Ira.